Back in 1995 I worked with my client Peter Barlow then VP Global Account Management and Major Projects for APV (Food Process Engineering Company) on developing a Major Account Management System. Now over 15 years on I ask:

What’s changed in Key Account Management 15 years on?

Building and maintaining profitable relationships with your most important customers is more challenging than ever. The stakes are even higher of investing reduced resources on a few customers (accounts) with that nagging doubt of “backing the wrong horse”

“… (Managers) often don’t realize or understand how markets change and believe sales to be just how it was fifteen years ago.” (TACK Sales Leadership Survey 2011)

“Doing business with and actually making money from your largest strategic ‘partners’ has never been more difficult….Only a few corporations are getting it right.” (Richard Ilsley, SMCG 2010)

This blog takes a hard look at strategic, key or major accounts (KAM) and why many senior executives remain concerned 15+ years on. To do this retrospective I have drawn on several current experts in the field including a paper by Richard Ilsley of SMCG, TACK International and Mercuri.

What’s Changed?

Many organizations still ignore the coming fight for customer value while facing big challenges to acquire and manage those customers. Many leading organizations can manage the increased sales complexity and working cross-functionally– too many have procrastinated and are only now addressing these issues. Developing a Key Account Management function far more difficult than 15 years age because of the following change drivers:

1. Decreasing importance of good relationships as more weight is given to the buying process technology provides readily available information in real-time – globally and free. So now more focus is on:

- Clear and to the point value offering up-front,

- Transparency in costing

- Early involvement of the customer’s senior management.

- Customers risk aversion means they are shifting this risk upstream to their suppliers

2. Increasing customer sophistication and independence in their requirements for service, driven by “utilization value” or “lost production” factor. This trend demands suppliers being real-time. Standard service packages are replaced with tailored services.

3. Increasing manufacturing capacity continues to exceed demand means, more than ever, that Customers are driving:

- Efficiency & speed of response

- Environmental awareness

- Cuts in non-value-adding parts of the business

- Rationalization to cut costs

- Customers are now in the driving seat

4. Increasing digital contact points for routine oriented tasks continues. Digital

self-service is now a prerequisite.

5. Increasing competitive intensity. Rather than competing on price, organizations are trying to offer higher service and quality that means increase customer knowledge and insight so they know:

- What to offer,

- Which customers to offer to and how to offer to these customers.

- Who really the customer”, “who owns the customer” – and most importantly “how shall we be customer centric and execute

Now, “Voice of customer” operations is becoming a critical capability”

6. Increasing sales specialization means cross-functional, team-oriented, and more complex. Sales reps now need to know how to engage in value and not price discussions. Sales managers now need lead more advanced sales teams within cross-functional organizations. Talent, competence and training will become key.

7. Increasing blending of roles and responsibilities across sales, service and marketing functions while new roles emerge like “Chief Customer Officer”. It follows that we are seeing more advanced use of matrix organizations as they struggle to collaborate on distributing information, how it impacts workflows and develop clear responsibilities to carry out tasks.

8. Increasing Customer and Sales Data presents a tsunami of data challenging firms to make sense of this deluge and then develop collective commitment to action.

(adapted from Valcon’s Sales Survey 2011)

Doing the same thing repeatedly and expecting different results

Summary – What worked well just a few years ago doesn’t any longer yet most don’t get it, such as:

- 65% of senior managers believe they rank in the top 25% of best practice performance when it comes to KAM.

- Most managers still think that a key account is a big customer who they happen to be selling to now, with a dedicated salesperson who gets a new title and a training seminar

- 80% of new product launches fail

- Two thirds of change initiatives in North America, still fail 15 years on.

- 44% of Sales VP’s are unhappy with their sales functions compensation schemes

What’s going wrong?

- Not identifying a very few critical success factors – in other words what must we get right with this Key Account?

- Not defining specifically what “value” means for the Key Account – and therefore incurring cost without any return

- Not measuring the true profitability of the Key Account – and so taking poor decisions

- Not adapting to the to regional or global management approaches

- Not engaging senior managers from across the business in Key Account strategic planning – assuming Key Account Management means “selling to big customers”

- Not understanding how the Key Account takes decisions, its strategic plans and needs, how it measures its suppliers and to engage at the highest level

- Not creating simple effective and collaborative Key Account growth plans

(adapted from Richard Ilsley, SMCG – Getting it Right with Key Accounts)

Backing the Right Horses

Key accounts adds complexity to selling because it involves managing both internal as well as external relationships. It means choosing the right accounts in which to invest significant resources to:

- Influence many people, both decision makers and influencers across several functional areas

- Cope with geographically dispersed organizations with several sites

- Provide specialized attention and services, such as logistical support, customize applications and information about product usage and performance.

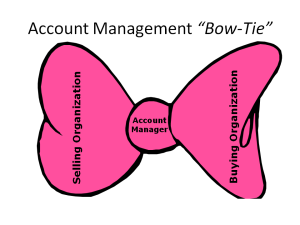

Consequently “Account Managers” are the knot in “The Account Management Bow Tie”.

The Account Manager’s “Bow Tie”

The Account Manager’s (AMs) role includes dealing with gatekeepers and influencers across the customer’s organization whilst understanding and even modifying their needs and decision criteria. At the same time, positioning the selling organization’s products and services, on the competition, and the benefits of working with the vendor on a long-term basis.

To carry out this AMs has able to motivate and align internal people who often contact the account for customizing solutions and operations. These people run the gamut of engineering, customer service, field service, product specialists as well as top management. It is also common for the AM to co-ordinates and build alliances with those firms in the Indirect Channel such as dealers, independent reps and the like.

Selling then becomes more marshaling resources across a range of buying locations, buying influences, and its own product, sales, and service units.

What implications does this have for Key Account Selection?

In the 1990’s trends highlighted the importance of selecting and resourcing key accounts, such as:

- Top 20% of customers yielded 75% of sales volume

- 50% of a typical company’s sales volume came from 10% of its customers

- 90% of sales came from 50% accounts

(O’Connell & Keenan Jr. 1990)

Today global markets are placing more demands on sales organizations.

- Providing coordinated sales and services at customer locations dispersed throughout the world.

- Realigning purchasing to include working with suppliers in product design, development, manufacture, and distribution.

- Maintaining preferred-vendor status in accounts looking to work more intensively with a smaller but higher value-added suppliers.

What has happened to Key Account Thinking today?

In 2010 a survey by Mercuri survey highlighted managing both edges of the Key Account Sword –  Operational and Corporate. Why? Because many fall into the trap of focusing too much on Operational Key Account Management (KAM) by providing a broad range of tools for understanding and analyzing key account and the competition. Too many executives assume that, if individual account managers do their job, all will be well.

Operational and Corporate. Why? Because many fall into the trap of focusing too much on Operational Key Account Management (KAM) by providing a broad range of tools for understanding and analyzing key account and the competition. Too many executives assume that, if individual account managers do their job, all will be well.

Unfortunately, they overlook the structural conditions and policy decisions needed to make a KAM program work. This discomfort arises because the issues are more difficult to tackle, leading many to ignore this aspect of KAM. They were asked, since launching their KAM programs

‘How much better are you performing today than you would have done without your KAM organization? Please estimate the revenue effect in percentages.’

- Somewhat Improved – 71% believed they had seen less than 26 % improvement

- Mostly Improved – 14 % reported between 26% to 50% improvement

- Greatly Improved – 9% stated improvement between 51% – 75%

- Substantially Improved – 6% pointed to more than 75%

What has prompted companies to engage in KAM?

- 89% of Companies surveyed said that key account management would increase in importance

- 90% say to improve customer satisfaction

- Almost 75% say to improve their competitive situation.

- 50% in response to customer demand.

This means the need for a long-term relationship between buyer and seller remains the goal 15 years on and the organizing principle, for KAM. The amount of up-front investment required alone dictates longer term relationships and a move away from a purely transaction based relationship.

What do we have to do to get it right?

- A clear simple key account strategy driven by the corporate strategy

- A clear competitive strategy that defines exactly where the growth is coming from and why along with clarity about how value is added to the Key Account

- Serious attention from the most senior managers across all disciplines

- A multidisciplinary team approach – not one Key Account Manager working in isolation (see Getting the Best Out of the Matrix Blog)

- Recognition that key account management means so much more than selling

- Very high-caliber people as Key Account Managers

- A never-ending drive to add real measurable value

- A ruthless focus on cost reduction

- A short set of simple common measures of success (key performance indicators)

- Clearly defined roles, responsibilities and incentives coupled to simple and accepted processes, tools and skills

- Enhanced knowledge and understanding (as opposed to collecting and storing data)

- Short simple feasible key account plans supported by regular formal performance reporting

Selecting the Right Key Accounts

It will be clear by now that the large opportunity costs means that deciding which customers are “key” is a crucial decision for any sales organization

‘Key Accounts’ are those who play a strategic role in our growth. So they can be ones where we sell nothing right now or are small or in new markets and of course the big ones whose loss would have a huge short-term impact. So, corporate strategy and key account strategy must be linked.

If you get it wrong with your key accounts then you get it wrong corporately

If the first point is that your company growth strategy and your key account strategy are inextricably linked then it follows that the most senior members of the management team must drive and be intimately acquainted with the key account strategy. Key account management is a board responsibility in just the same way as capital investment, market entry and acquisitions. Key account management demands a multidisciplinary team approach

If the first point is that your company growth strategy and your key account strategy are inextricably linked then it follows that the most senior members of the management team must drive and be intimately acquainted with the key account strategy. Key account management is:

- A board responsibility in just the same way as capital investment, market entry and acquisitions.

- Demands a multidisciplinary team approach

- So important to your business that it must drive your decisions – right across the business.

- Far more work and requires far more ability that one person can ever handle.

- Integrated and multidisciplinary because the decisions you will take impact every department in the business (Richard Isley, SMCG)

Segmenting Accounts – Three Phases

Begin with an audit of those accounts currently regarded as “Key” to see if they pass the following selection process. Before doing so it worth considering, what is a sale? (in the context of key accounts).

A stream of orders each with its own embedded transaction costs – the costs of order-acquisition and order-fulfillment associated with a particular customer, or customer type (Frank Cepedes)

Common causes of poor selection

- Accounting systems don’t capture order streams’ expenses as part of customer acquisition

costs, and

costs, and - Account selection policies don’t distinguish between customer groups

- Account order patterns are not considered about how they impact use, both in throughput and product mix

- account selection decisions focus only on the order and ignore customer maintenance considerations

A McKinsey survey of 2400 firms showed after-sales business accounts for 10-20% of revenues and between 20-67% of total contribution margins (higher end for capital-equipment businesses.

A process that makes explicit the near-term potential and the longer-term resources required to keep up vendor value and reap profits from Key Account. Without such a process, key accounts can become increasingly unprofitable, as the buyer’s power allows them to demand higher levels of support at lower prices.

“Good account selection builds capabilities by keeping the supplier in touch with market trends. Poor selection, however, can incrementally lead to suppliers to build increasingly obsolete capabilities” (Frank Cespedes)

For example, IBM’s fate in the mid 80’s and their investment in mainframes to service their installed base of key accounts. The problem was “not” that IBM were insufficiently “close to the customer”. Rather the problem was that they were getting closer and closer to the “wrong” customers and therefore missed an emerging stream of customers who didn’t want or need mainframe thinking or products.

Phase One focuses on profit potential, measured in terms of incremental sales potential and how much the customer values the vendor’s support services. Most companies segment their customers by sales volume. But there must also be incremental volume to prove investing in a key account opportunity. The traditional 80/20 rules of selection doesn’t tell you where and how to allocate resources.

With regard to support services, an assessment needs to make how willing customers are willing to pay for support services.

Phase Two focuses on identifying those accounts that, because of their support requirements, provide profitable organizational learning. High service levels can generate lucrative after-sale opportunities, but only if the vendor makes investments in facilities and ability required to provide excellent support. For key accounts, support often includes modifying existing information systems, field and technical service, and billing.

Also one has to consider screening accounts according to common support priorities. The goal is to find accounts which need similar support services so that the seller can:

- Invest in those support capabilities valued by global key accounts

- Accelerate learning and support excellence in selected areas so that it can cost-effectively standardize such services

- Develop a coherent support strategy to select the type of demands it will respond to.

Without this process, support services will develop in response to average customer needs, many of which are not shared by key accounts, or will proliferate expensively in response to each big account’s demands.

Phase Three is the last screen which focuses on transactions between customer-seller, and whether they complement the seller’s economics. Here the focus is identifying the cost drivers, like order size, order frequency, the product mix, etc.

Conclusion, any key account management system must weigh customer value and vendor-specific costs. When there are clear criteria for determining the profit potential, learning benefits and cost drivers associated with customers, the firm knows when and when not to incur substantial commitments required for effective key account relationships. If they don’t, firms can chase volume and hurt profits, have more difficulty in coordinating resources across functional groups, and can fall prey to competitors who do manage account selection effectively.

Developing Account Relationships

Selection decisions are only the starting point in managing key accounts. The goal is developing a co-operative relationship and not a series of transactions. Therefore one can classify most accounts into transactional and relationship (partnering) buyers in general, the more critical the impact of the suppliers products/services in the buyer’s business, the more customized the specifications need to be. The more customization requires investments not easily transferable to another vendor or customers, the more there is potential and need for relationships and not transactions.

It is a mistake to think relationship buyers are inherently more profitable, the message to align the right marketing and sales processes to the different types of customers. If there is no distinction made then two common errors in account management systems can occur:

- wasting time-consuming and price-inflating relationship programs in transaction buyers

- approaching relationship buyers with transaction-oriented strategies

These differences affect account management, ranging for pricing (e.g. penetration pricing to develop a relationship vs. skim or supply demand pricing to maximize transaction revenues), to product policy (e.g. relative willingness of the seller to devote time and resources to customization and the willingness of the buyer to share confidential information) and distribution ( e.g. investments in on-line systems).

Account Co-ordination

A crucial aspect of an account relationship is the seller’s ability to co-ordinate its personnel who deal with the customer. Surveys of key account programs rank this among the most important factors affecting success of these programs. (Managing National Accounts, Linda Platzer and Jerome Colletti and Gary Tubridy “Effective Major Account Management”)

Conversely, a lack of systems for coordinating the vendor’s efforts is among the most common complaints by customers and account managers.

Finally

So many talk about Key Accounts yet few actually manage them. Those that do, will take the prize and leave those talkers wondering.

© Copyright All Rights Reserved, The Crispian Advantage [2010-2012]. Unauthorized use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Nick Anderson, The Crispian Advantage